Fast, reliable and hassle-free ITIN. Apply today!

ITIN rapido, confiable y sin complicaciones. Solicitalo hoy!

Fast, reliable and hassle-free ITIN. Apply today!

ITIN rapido, confiable y sin complicaciones. Solicitalo hoy!

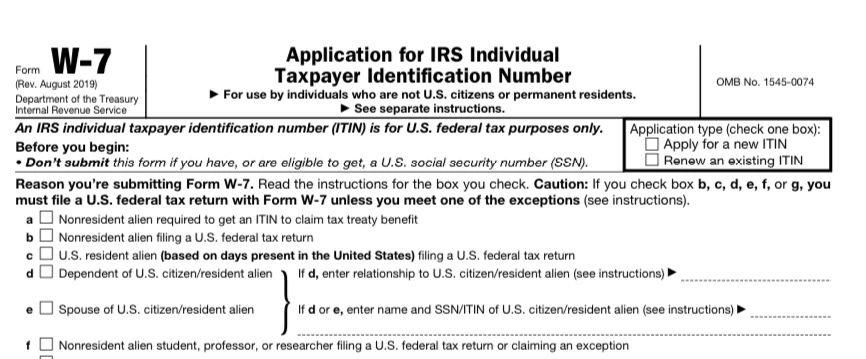

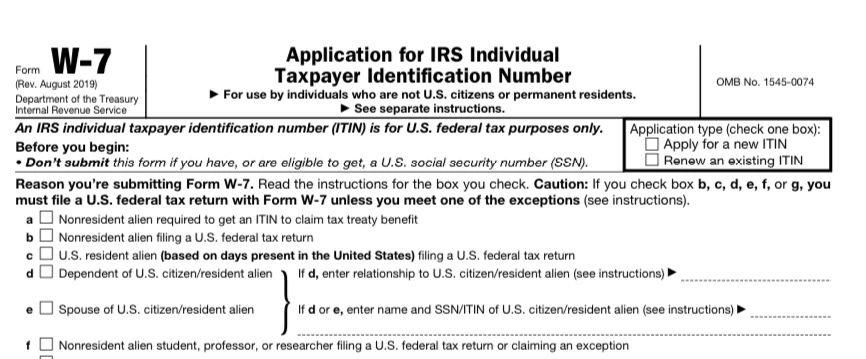

An Individual Taxpayer Identification Number (ITIN) is issued by the IRS to individuals who must file U.S. taxes but are not eligible for a Social Security Number (SSN). It is used solely for tax purposes, regardless of immigration status.

Un Número de Identificación Personal del Contribuyente (ITIN) es emitido por el IRS a personas que deben declarar impuestos en EE. UU. pero no califican para un Número de Seguro Social (SSN). Sirve únicamente para cumplir con las leyes fiscales y procesar declaraciones y pagos de impuestos, sin importar el estatus migratorio.

A Certifying Acceptance Agent (CAA) is authorized by the IRS to help individuals who need an ITIN and are not eligible for an SSN. The CAA reviews and authenticates documents, verifies identity, and submits forms to the IRS. For dependents, they can verify passports and birth certificates, returning documents after review. Applicants outside the U.S. can also apply for an ITIN through a CAA.

Un Agente Certificador (CAA) es una persona o entidad autorizada por el IRS para ayudar a quienes necesitan un Número de Identificación de Contribuyente (ITIN) y no califican para un SSN. El CAA revisa y autentica documentos, verifica identidad y envía los formularios al IRS. Puede verificar pasaportes y actas de nacimiento de dependientes y devuelve los documentos tras la revisión. Personas fuera de EE. UU. también pueden aplicar a un ITIN a través de un CAA.

Does this apply to you?

Does this apply to you?

If so, you must apply for an ITIN.

¿Aplica esto para usted?

Si cumple con alguno, debe solicitar un ITIN.

Does this apply to you?

Does this apply to you?

If so, you must apply for an ITIN.

¿Aplica para usted?

Si aplica, debe solicitar un ITIN.

If you need to file a tax return and your ITIN has expired or will expire, the IRS recommends renewing it now to avoid delays. Using an expired ITIN allows the return to be processed, but no credits or refunds will be applied. You will receive a notice explaining the delay and ITIN expiration.

Si necesita presentar su declaración de imp

If you need to file a tax return and your ITIN has expired or will expire, the IRS recommends renewing it now to avoid delays. Using an expired ITIN allows the return to be processed, but no credits or refunds will be applied. You will receive a notice explaining the delay and ITIN expiration.

Si necesita presentar su declaración de impuesto y su ITIN ha expirado o expirará antes de hacerlo, el IRS recomienda renovar ahora para evitar retrasos. Usar un ITIN vencido permitirá que la declaración se procese, pero sin créditos ni reembolsos. Recibirá un aviso explicando la demora y la expiración del ITIN.

Acceptable documents include:

Acceptable documents include:

Dependents proving U.S. residency must provide extra original documents if the passport lacks an entry date.

Documentos aceptables incluyen:

Dependientes que deben probar residencia en EE. UU. necesitan documentación adicional si el pasaporte no indica fecha de entrada.

Allow 7 weeks for the IRS to notify you of your ITIN application status (9–11 weeks during peak season, Jan 15–Apr 30, or from overseas). If you haven’t received a response, you can call us to check your status.

Permita 7 semanas para que el IRS notifique el estado de su solicitud de ITIN (9–11 semanas si aplica entre el 15 de enero y e

Allow 7 weeks for the IRS to notify you of your ITIN application status (9–11 weeks during peak season, Jan 15–Apr 30, or from overseas). If you haven’t received a response, you can call us to check your status.

Permita 7 semanas para que el IRS notifique el estado de su solicitud de ITIN (9–11 semanas si aplica entre el 15 de enero y el 30 de abril o desde el extranjero). Si no recibe respuesta al final de ese período, puede llamarnos para verificar el estado.

If your ITIN wasn’t included on a U.S. federal tax return at least once for tax years 2021, 2022, or 2023, your ITIN will expire on December 31, 2023 You need to take action to renew it if it'll be included on a U.S. federal tax return.

Si su ITIN no se incluyó en una declaración federal de EE. UU. en 2021, 2022 o 2023, expirará el 31 de

If your ITIN wasn’t included on a U.S. federal tax return at least once for tax years 2021, 2022, or 2023, your ITIN will expire on December 31, 2023 You need to take action to renew it if it'll be included on a U.S. federal tax return.

Si su ITIN no se incluyó en una declaración federal de EE. UU. en 2021, 2022 o 2023, expirará el 31 de diciembre de 2023. Debe renovarlo si se usará en una declaración futura.

We love our customers, so feel free to visit during normal business hours.

Today | Closed |

Lunes a viernes

10:00 am - 6:00 pm

Sábados

Solo Citas/By appointment ONLY

This website uses cookies. By continuing to use this site, you accept our use of cookies.